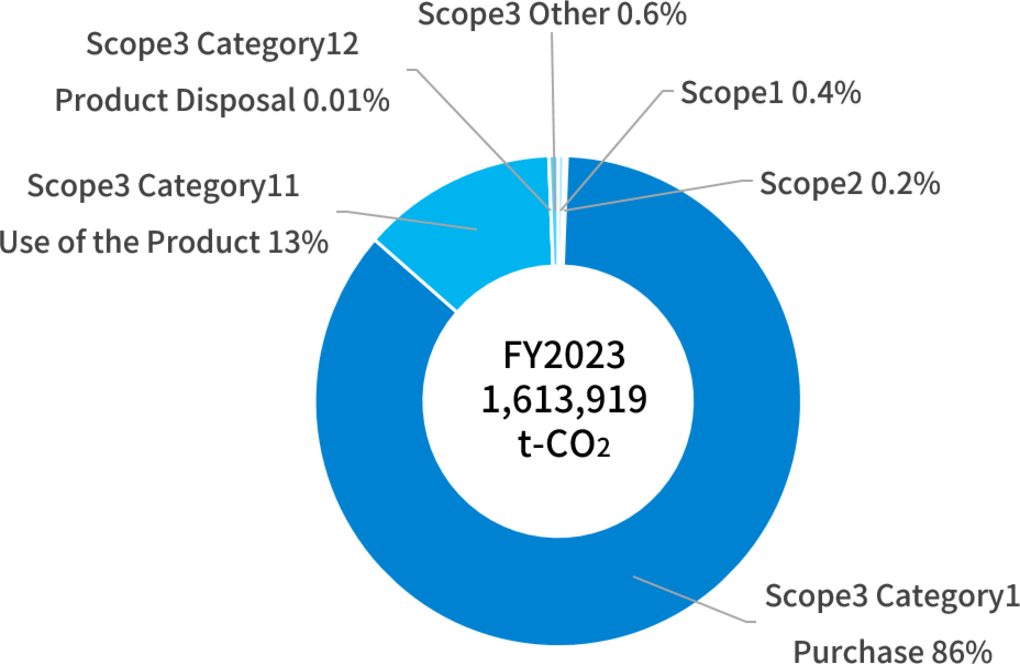

<Greenhouse gas emissions in fiscal 2023 (Scope 1-3)>

| Scope | Scope 3Category | Emissions(t-CO2) |

|---|---|---|

| Scope 1+2total | 10,133 | |

| Scope 1 | 7,124 | |

| Scope 2 | 3,009 | |

| Scope 3 | 1 Purchase | 1,380,365 |

| 2. Capital goods | 4,837 | |

| 3. Other fuels | 2,034 | |

| 4. Transportation (upstream) | 1,666 | |

| 5. Waste | 143 | |

| 6. Employee Business Travel | 441 | |

| 7 Employee commuting | 1,044 | |

| 11 Use of the Product | 213,174 | |

| 12 Product Disposal | 81 | |

| Scope 3 total | 1,603,786 | |

| total | 1,613,919 | |

<Calculation results of greenhouse gas emissions (Scope 1-3) for fiscal 2023>

*Scope 3: 8. Leased assets (upstream), 9. Transportation (downstream), 10. Product processing, 13. Leased assets (downstream), 14. Franchises, and 15. Investments are not included in the calculations as they are not related to our business.

*Scope 3 11 Product use and 12 Product disposal are calculated for five companies: Kyowa Medical Corporation Co., Ltd., Kurihara Medical Instruments Kuribara Medical Instruments Co.,Ltd., Ltd., ALVAUS, Inc., Ltd., Akita Medical Instruments Co., Ltd., and SANO MEDICAL INSTRUMENTS Co., Ltd. Co., Ltd.