These guidelines establish the basic matters concerning corporate governance at MEDIUS Holdings Group (hereinafter referred to as "the Company" or "Our Group"), and are intended to protect the interests of shareholders, customers, local communities, business partners, employees, etc. Our purpose is to fulfill our social responsibilities to all stakeholders and achieve sustainable growth and increase corporate value for our group.

Under our management philosophy of "contributing to local medical care," our group strives to achieve sustainable growth and improve corporate value through honest and fair business activities, and contribute to the sustainable development of society. I aim to do that. We believe that building a corporate governance system is important as a foundation for achieving this, and we play an active role in the management of our group, formulating group strategies and policies, providing guidance and advice to each group company, and We will strive to ensure thorough corporate governance by compiling important matters.

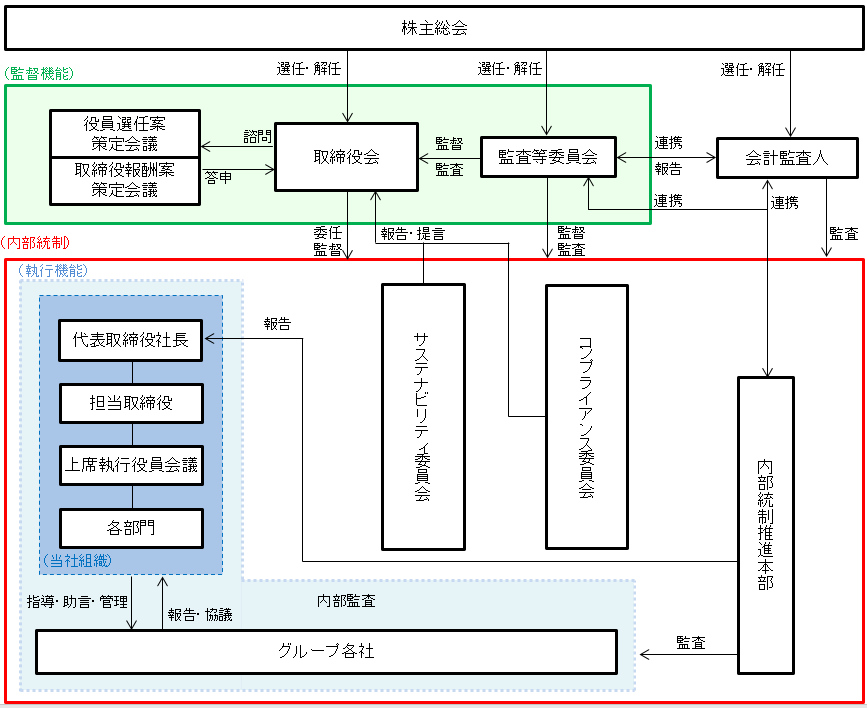

Overview of our group’s corporate governance system

Aiming to further enhance corporate governance, the Company aims to clarify executive responsibilities and streamline decision-making through delegation of authority, and has established a company with an audit and supervisory committee to further strengthen the supervisory function of the board of directors. We are hiring

The Board of Directors makes decisions on important matters for the Group, such as matters stipulated by laws and regulations and the Articles of Incorporation, as well as discussions regarding management strategies, medium- to long-term plans, and management issues, and supervises the execution of duties by directors. Furthermore, in order to speed up and improve decision-making efficiency, decisions regarding business execution will be delegated to the representative director and executive directors to the maximum extent possible. Through this, we aim to realize management strategies while ensuring efficiency, soundness, and transparency, and achieve target management indicators.

In addition, in order to ensure the appropriateness of the Group's operations, the Board of Directors has established the "Basic Policy for Internal Control Systems" based on the Companies Act and the Enforcement Regulations, and based on this, the internal control system has been constructed and operated. I will do it. In order to further strengthen the supervisory function of the Board of Directors, at least one-third of the Board of Directors will be made up of independent outside directors.

The Company strives to provide directors with appropriate and necessary information so that they can effectively fulfill their roles and responsibilities. In addition, to enable constructive discussions and exchanges of opinions at Board of Directors meetings, related materials will be distributed in advance to those attending the Board of Directors' meetings, and prior explanations will be provided to outside directors as necessary.

The Board of Directors analyzes and evaluates its effectiveness every year, discloses the results of its evaluation, and takes measures based on this to further improve its functions.

The Audit and Supervisory Committee independently audits the execution of duties by the Board of Directors, directors, and executive officers, decides on proposals regarding the appointment, dismissal, and non-reappointment of accounting auditors to be submitted to General Shareholders Meeting and independently handles matters stipulated by laws and regulations, such as accounting audits. I will implement this from my perspective.

The Audit and Supervisory Committee is entrusted by shareholders to conduct audits, and its members include full-time Audit and Supervisory Committee members who are familiar with the Company's business, and part-time Audit and Supervisory Committee members who are involved in corporate management, finance/accounting, and law. We will appoint a person who has appropriate knowledge regarding such matters.

The full-time Audit and Supervisory Committee members collect information from directors, the Internal Audit Office, and other employees by attending important internal meetings, visiting each division of the Group, engaging in dialogue, and viewing important resolution materials. We will share this information at the Audit and Supervisory Committee and the council with the corporate auditors of each group company in an effort to improve the auditing environment within our group.

In addition, in order to carry out the duties of the Audit and Supervisory Committee appropriately and effectively, necessary assistant employees will be appointed. The independence of auxiliary employees is guaranteed.

The Board of Directors establishes basic policies for the internal control system, builds systems for compliance, risk management, ensuring the reliability of financial reporting, etc., and supervises the operational status of these systems by utilizing the internal audit department and others. The Compliance Committee, chaired by the representative director, and the Risk Committee, which is a specialized subcommittee of the Sustainability Committee, have been established to deliberate important matters related to compliance and consider risks, and to share their findings with the Board of Directors and the Audit and Supervisory Committee. I will report that.

We consider the internal audit department, including those of group companies, to be important, and have established an internal audit office and assigned human resources to play this important role. Based on the annual internal audit plan, the Internal Audit Office conducts audits regarding internal controls and compliance status from the viewpoint of legality, appropriateness, efficiency, etc. of the business execution status of each division of the Group. . The audit results, etc. are reported directly to the Board of Directors and the Audit and Supervisory Committee, in addition to being reported to President and CEO Medius Holdings Co., Ltd. and president on the business execution line.

The Company will establish a Legal Compliance Promotion Department for the purpose of providing legal support for the entire Group and promoting and strengthening the compliance system.

The Legal and Compliance Promotion Department will be staffed with personnel who are well-versed in laws and regulations, including in-house lawyers, and will work with each group company to establish a system for ethical and legal compliance, and to ensure that it is operated appropriately at each company. We will support each company.

The Company will ensure the independence of the accounting auditor and sufficient audit time to enable high-quality audits, and will provide opportunities for regular exchange of opinions with the Company's representative director. In addition, the director in charge of finance will hold discussions with the accounting auditor as appropriate and strive to deepen mutual recognition and understanding. In addition, we will regularly establish opportunities for the exchange of opinions and discussions between the accounting auditor, the Audit and Supervisory Committee, and the Internal Audit Office.

The Audit and Supervisory Committee receives reports from the accounting auditor on its activities every year, exchanges opinions with the representative director and the director in charge of finance, and evaluates the appropriateness of the audit quality and remuneration level of the accounting auditor. We will check their independence and expertise.

The Audit and Supervisory Committee and the Accounting Auditor regularly exchange opinions in order to make the corporate governance of the Group more appropriate. The Audit and Supervisory Committee regularly receives reports from the Internal Audit Office and the Legal Compliance Promotion Department regarding audit plans, internal audit results of each department and subsidiary, other audit-related matters, and the status of compliance promotion. In addition, as necessary, the full-time Audit and Supervisory Committee members, internal audit staff, and compliance promotion staff will hold meetings to share information and work together.

The Executive Selection Proposal Formulation Meeting (voluntary nomination committee) and Director Remuneration Proposal Formulation Meeting (voluntary compensation committee), which are advisory bodies to the Board of Directors, consist of outside directors and representative directors who are audit and supervisory committee members, and the director in charge of human resources. The board is chaired by the representative director.

The Officer Selection Proposal Formulation Meeting deliberates on candidates for directors of the Company (excluding directors who are members of the Audit and Supervisory Committee) and officers of each company in the Group, and recommends candidates for officers to the Board of Directors. The Officer Selection Proposal Formulation Committee will consider the following factors when deliberating officer candidate proposals.

Qualifications and abilities of officers: Appropriately fulfilling the duty of due care of a prudent manager and loyalty regarding the execution of duties, and having the qualifications to contribute to the sustainable profit growth and enhancement of corporate value of the Company. Business executive officers must be familiar with the Group's business and have the ability to properly carry out the Group's management.

When the Company proposes a candidate for director at General Shareholders Meeting, the Company will explain the reasons for selecting the candidate in the convocation notice.

At the director remuneration proposal formulation meeting, we consider the level and indicators of remuneration for directors (excluding directors who are audit and supervisory committee members), discuss appropriate remuneration amounts for directors, and report to the board of directors. Compensation for directors (excluding directors who are audit and supervisory committee members and outside directors) consists of basic compensation (fixed compensation), bonuses (short-term incentive compensation), and stock compensation (medium- to long-term incentive compensation). The remuneration level and individual remuneration for such directors will be determined by a resolution of the Board of Directors within the remuneration limit approved at General Shareholders Meeting.

Remuneration for outside directors (excluding directors who are members of the Audit and Supervisory Committee) shall be limited to basic remuneration (fixed remuneration) in consideration of their role in supervising the management of the Company from an objective and independent standpoint.

Remuneration for directors who are members of the Audit and Supervisory Committee shall be limited to basic remuneration (fixed remuneration) in consideration of their role in supervising and auditing management. Individual remuneration, etc. for directors who are members of the Audit and Supervisory Committee will be determined through consultation among directors who are members of the Audit and Supervisory Committee, within the remuneration limit approved at the General Shareholders Meeting.

The level of remuneration for all directors will be determined based on their job responsibilities, etc., using objective remuneration survey data from external specialized organizations.

Furthermore, the Audit and Supervisory Committee members participating in the advisory body report to the Audit and Supervisory Committee regarding the status of the selection of directors (excluding directors who are Audit and Supervisory Committee members) and the remuneration determination process, and the appropriateness of the report is discussed. to hold. The Audit and Supervisory Committee will exercise its right to express opinions at General Shareholders Meeting when the need arises.

When new directors are appointed, we will provide them with training on the Companies Act and other related laws and regulations, compliance, management strategy, finance, etc., as necessary, and we will continue to provide training on these topics as necessary after they take office, and strengthen our efforts to resolve management issues. as the foundation of In addition, outside directors will be given an overview of the Group's business and tours of major locations as necessary.

We have determined that all of our outside directors are independent, and have notified the Tokyo Stock Exchange. The Company recognizes the usefulness of outside directors, and enables appropriate decision-making and supervision by stimulating discussions at board meetings through questions and opinions from outside directors, and by presenting opinions from various perspectives from outside directors. The Company has determined that outside directors will contribute to the enhancement of corporate governance.

The Company believes that appointing independent outside directors with more diverse specialized knowledge and experience will further invigorate discussions within decision-making and supervisory bodies, including the Board of Directors, and ensure appropriate decision-making and oversight. We believe that it is guaranteed. Therefore, if there is a suitable person with the background, experience, and knowledge that will contribute to the enhancement of our corporate governance, we will continue to elect such a person as an independent outside director.

The independence of outside directors is judged on the basis that none of the following items apply.

In order to promote lawful and fair business activities, our group has established compliance guidelines that all directors, executive officers, and employees must abide by, and we are working to ensure that these guidelines are fully disseminated. Our company will regularly share and confirm information at the Board of Directors and Compliance Committee regarding the status of compliance with these compliance guidelines.

The Company will disclose financial information such as the financial condition and Results of Operations of the Group, as well as non-financial information such as information related to management strategies / issues, risks and governance, in a timely, appropriate and fair manner in accordance with laws and regulations. , We will take the initiative in providing information other than disclosure based on laws and regulations.

While securing internal reserves necessary for strengthening the management base and expanding business over the medium to long term, we will strive to return profits by comprehensively considering business performance, future capital demand, etc. In addition to stably increasing dividends through profit growth with a consolidated dividend payout ratio of 30% or more as a guideline, we will also consider improving the dividend payout ratio in the medium to long term depending on conditions such as capital demand and profit growth.

The Company recognizes that General Shareholders Meeting is the Company's highest decision-making body and is an important forum for constructive dialogue with shareholders. Our basic policy is to explain to shareholders the status of our business and the issues that our company needs to address, and to have sufficient discussion, including question-and-answer sessions, before voting on proposals.

In addition, in order to contribute to the Company's sustainable growth and increase in corporate value over the medium to long term, we will establish a system for constructive dialogue with shareholders outside of General Shareholders Meeting.

The Company will endeavor to send the convocation notice as soon as possible so that shareholders can secure sufficient time to consider the agenda before the general meeting, and will disclose the contents on the Company's website before sending the convocation notice.

The Company will create an environment for the exercise of shareholder rights so that the rights of shareholders are ensured. Securing the voting rights of shareholders is as described in "15. General Shareholders Meeting."

If a resolution has been approved at General Shareholders Meeting, but it is recognized that there were a significant number of votes against it, the Board of Directors will conduct an analysis of the cause and, if necessary, disclose the results of that analysis to shareholders.

When the Company proposes to the General Shareholders Meeting that some of the matters to be resolved at the General Meeting of Shareholders be delegated to the General Shareholders Meeting of Directors, the Board of Directors will seriously discuss whether the Company has a structure suitable for the proposal. The Company will ensure shareholder equality, give consideration to minority shareholders, and give due consideration to the exercise of rights granted to minority shareholders.

In order to ensure that constructive dialogue with shareholders contributes to the Company's sustainable growth and the improvement of corporate value over the medium to long term, the Company appoints President and CEO Medius Holdings Co., Ltd. as the officer in charge of IR, and the President himself conducts dialogue, as well as the Public Relations and IR Department. will be the department in charge of IR and will support dialogue.

For shareholders and investors, in addition to disclosing information on our website, we hold Financial Results once every six months, and regularly hold small meetings and briefing sessions for individual investors.

The officer in charge of IR communicates the Group's thinking to shareholders and investors through dialogue, and provides feedback on the opinions and requests received from shareholders and investors to directors, management executives, and outside directors to share a common understanding of issues. In addition to sharing information on a daily basis with each department within the company, the IR department creates disclosures such as financial results and IR materials using graphs and charts in an easy-to-understand manner, and communicates with all stakeholders including shareholders and investors. We will support dialogue.

As a general rule, we conduct regular shareholder surveys once a year in an effort to understand our shareholder structure.

The Company has a stock policy when it is possible to maintain or develop a medium- to long-term business relationship by holding stocks of business partners or other companies in the same industry, or when strategic importance such as business expansion is recognized. I will hold it. In addition, the Board of Directors will periodically verify the rationality of holding each strategically held stock for each stock, and reduce the number of shares whose holding significance has declined.

Regarding the exercise of voting rights of strategically held shares, we will carefully examine the content of the agenda item, determine whether it will contribute to the improvement of shareholder value, and then exercise voting rights appropriately. Regardless of company proposals or shareholder proposals, we will not make a positive judgment regarding proposals that damage shareholder value.

In principle, we do not engage in related party transactions within our group. However, if a transaction must be conducted, decisions will be made after sufficient deliberation by the Board of Directors, which includes multiple independent outside directors, regarding the appropriateness of the terms of the transaction and the method for determining it, taking into account the perspective of ensuring independence. .

In addition to the above-mentioned prior deliberation, at the end of each fiscal year, we obtain confirmation letters from directors and audit and supervisory committee members, and in addition, the management department checks accounting books, etc. to confirm whether transactions are being conducted based on the content of the deliberation. We will carry out a thorough check.

The establishment, revision, or abolition of these guidelines shall be determined by a resolution of the Board of Directors.