ASOURCE®TIMES

今年10月に消費税が8%から10%に引き上げられるのに伴い、保険診療の初診料や再診料が値上げされる。こうした消費増税対応によって医療機関の補填は十分に解消されるのだろうか、懸念される問題点を探った。

保険医療は、消費税非課税になっているため、医療機関が物品などを購入する際に支払った消費税は患者・保険者に転嫁できず、医療機関が最終負担者となる。このため、2019年10月に予定されている消費税率の引き上げによって、医療機関の仕入れ税額相当額(控除対象外消費税)負担が増加し、経営を圧迫してしまうことから、特別の診療報酬プラス改定で補填を行う運びだ。

消費税をめぐっては、2014年の5%から8%への引き上げに伴う補填状況に関して、厚労省が2015年11月に公表していたデータに誤りがあったことを2018年7月の診療報酬調査専門組織「医療機関等における消費税負担に関する分科会」で報告し、大きな論議を呼んだ。病院全体の補填率が102.36%としていたものが、新たな調査では82.9%と補填不足になっていた事実が明らかにされた。特に特定機能病院は、61.4%と大幅な補填不足だった。この背景には、課税経費率や診療報酬の算定回数について、見込みと実績との間にズレがあったことや、収益に占める入院料などの割合を考慮しなかったことがあったとされる。

このため、今年10月の消費増税対応改定においては、前回の2014年度消費増税対応改変をリセットし、5%から10%に対応する点数引き上げを実施。基礎データの精緻化、医療機関の分類の精緻化、医業収益に占める入院料割合の勘案、診療所と病院との財源配分の調整を行った。

今年10月の消費増税対応の診療報酬改定では、薬剤と償還できる特定保険医療材料については、2%増税分引き上げる以外は、個別の点数ではなく、初・再診料と入院基本料等基本診療料の引き上げで対応する。改定の主な点数としては、初診料は、現在の282点から288点へ6点の引き上げ、診療所や中小病院の再診料は72点から73点へ1点引き上げされる。大規模病院の急性期一般入院基本料は、50〜59点アップされる。7対1特定機能病院入院基本料は、119点アップされる(表1)。

消費増税に伴う診療報酬全体の改定率は、19年度予算編成過程でプラス0.41%と決まった。各科改定率は、医科プラス0.48%、歯科プラス0.57%、調剤プラス0.12%。

高額な医療機器購入に当たっては、医療機関の消費税負担も高額であり、法人税・所得税に対し、設備投資への支援措置が行われる。ただし、公立大学法人、学校法人、国公立・公立病院など公益法人の医療機関は、法人税が非課税なので、支援措置の対象外となる。また、「医師および医療従事者の働き方改革の推進のための器具・備品、ソフトウエアの特別償却」、「地域医療構想の実現のための病院用等建物およびその付属設備の特別償却」の2項目が新たに導入され、これまでの「高額な医療用機器特別償却制度」の延長を含めた3項目について、特別償却の拡充・見直しがなされる。これにより、医療機関の設備投資が促進されると期待されている。

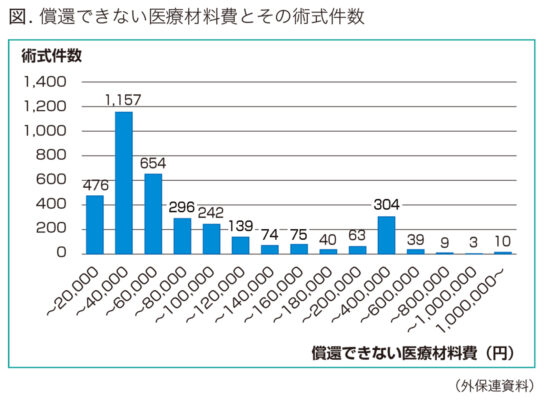

こうした中で、医療材料費が高額な手術の割合が高い医療機関では、補填不足となる可能性が指摘されている。外科系学会社会保険委員会連合(外保連)の調査によると、手術試案に使用している3,581の術式のうち、償還できない医療材料費は「2〜4万」が1,157術式でもっとも多く、「20〜40万」304術式、「100万円以上」10術式で、高額な医療材料費が手術料に含まれる術式が少ないことがわかった(図)。

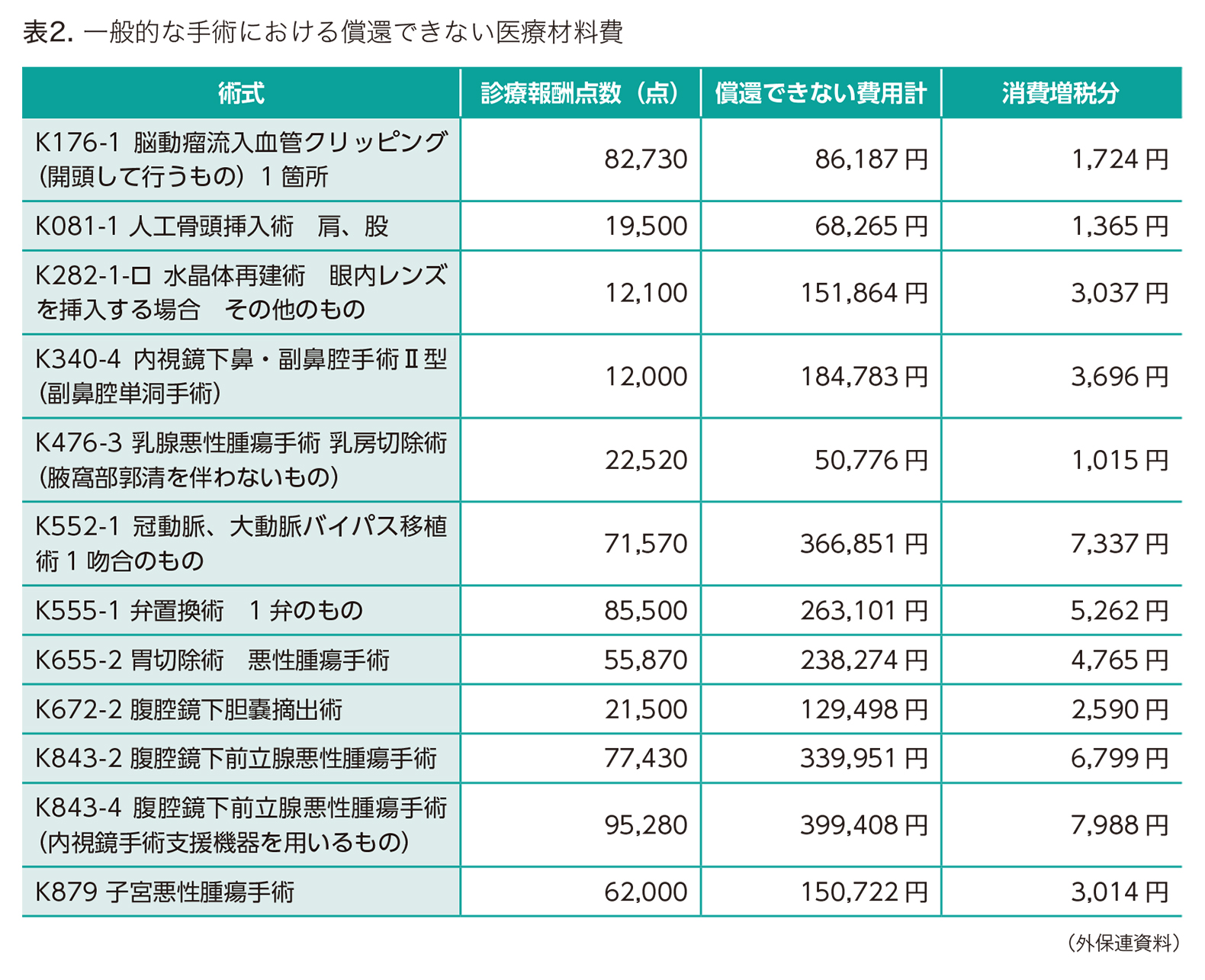

一般的な手術における償還できない医療材料費の例としては、内視鏡下鼻・副鼻腔手術II型(副鼻腔単洞手術)が挙げられる。診療報酬点数は1万2,000点だが、償還できない費用は18万4,783円で消費税分1万8,478円(増税分3,696円)を加えると、支出は計20万3,261円で、マイナス8万3,261円となる(表2)。

償還できない医療材料が高額な術式の例としては、ロボット支援手術が挙げられる。腹腔鏡下噴門側胃切除術・悪性腫瘍切除術(ロボット支援手術)の場合は、診療報酬点数が7万5,730点だが、償還できない費用は73万69円で、消費税分7万3,069円(増税分1万4,601円)を加えると、支出は計80万3,138円となる。4万5,838円の赤字で、手術料だけでは手術スタッフの人件費を賄えない。

また、近年の手術においては、医療安全の観点から医療材料がディスポーザブルのものにとって代わるようになり、その占める割合も多くなっており、消費増税の影響は大きいとみられる。

外保連としては、償還できない材料費が診療報酬額を超える場合、その術式の診療報酬点数の増点を厚労省に要望している。

一方で、消費増税などで、医療機関の経営が厳しさを増すなか、コスト削減として医業支出の相当部分を占める医療材料などを複数の病院が共同で購入する動きが見られている。国立大学の42病院が、2016年から医療消耗品の共同購入を開始し、仕入れを一本化することで、年間3億円の削減を達成している。また、民間病院でも医療法人単位での仕入れをとりまとめたり、共同購買スキームを利用した医療材料などの調達を集約化する動きがある。

今回の8%から10%の消費増税を、診療報酬のみで対応することになっているが、償還できない医療材料を使用する手術を多く行う医療機関にとっては、補填が十分でない可能性が高く、今後の詳細な検証作業が望まれる。