Publication date: 2023.06.27

Japan's long-term care insurance system was launched in April 2000 as an insurance system in which society as a whole supports nursing care for the elderly. The system of medical care and welfare up to that point was reorganized, and it became possible to comprehensively use various nursing care services according to the user's choice. We will summarize the mechanism and service contents of this system.

The long-term care insurance system is an insurance system that pays expenses to people who need long-term care and supports them in receiving appropriate services. The aim is to support the independence of the elderly and reduce the burden on family caregivers. This system is operated by local governments nationwide and is funded by paid insurance premiums and taxes. Long-term care insurance premiums are paid together with medical insurance premiums for category 2 insured persons aged 40 to 64, and separately from medical insurance premiums for category 1 insured persons aged 65 and over.

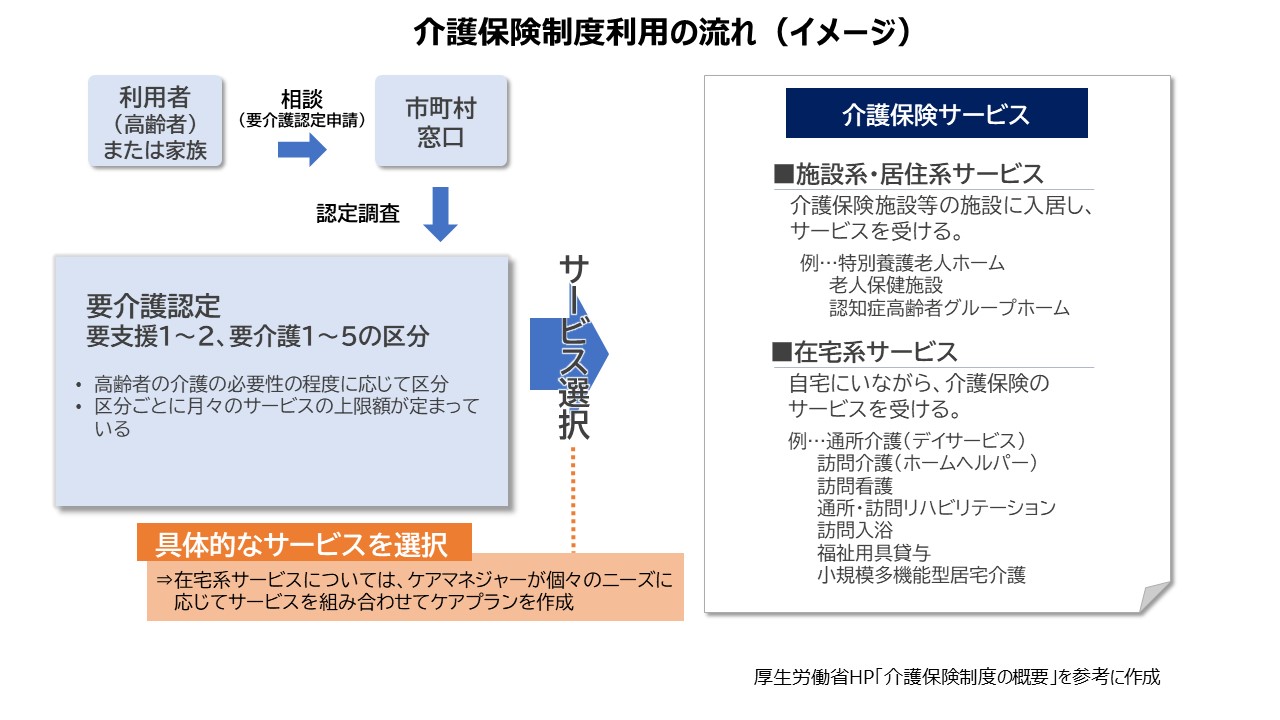

In principle, those who receive the service are in a state of needing constant nursing care due to bedridden or dementia, etc. (needing nursing care) or in a state of needing support for daily life such as housework and dressing (support required). You are an insured person and must apply to the local government to be certified as needing long-term care or support. However, Category 2 insured persons who require nursing care or support due to age-related diseases (specific diseases) such as terminal cancer, presenile dementia, and rheumatoid arthritis are also eligible. The survey that determines the certification is conducted by an investigator who visits a person's home and other places to check their mental and physical condition. The review judgment is based on the survey results and the doctor's opinion, and the computer will make a primary judgment of the level of long-term care. Based on the results, the long-term care certification examination committee makes a secondary judgment of the level of long-term care required and decides. After that, the care manager in charge creates an appropriate care plan and provides nursing care services based on it.

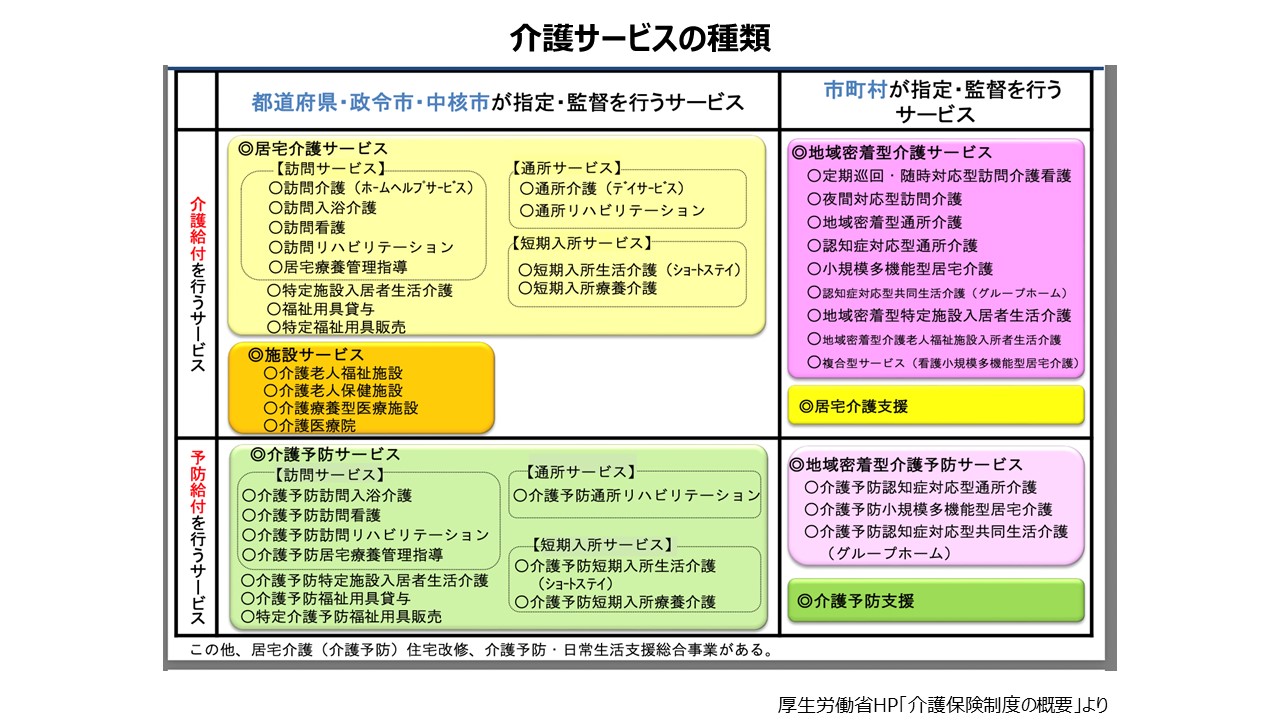

The types of long-term care services under the long-term care insurance system include preventive benefits and long-term care benefits. Preventive benefits are available to those who have been certified as needing support 1 or 2. The aim is to improve their condition and prevent progression to needing long-term care so that they can live on their own. You can receive services that support the maintenance and improvement of physical functions such as living support such as eating and bathing and rehabilitation. Services are divided into services provided by prefectures and services provided by municipalities. Specifically, home helpers and nurses visit homes directly to provide care, nursing, rehabilitation, etc. You can also go to a day service center or stay at a nursing home for a short period of time (short stay) and receive services such as meals, rehabilitation, and bathing. It is also possible to borrow nursing care equipment such as wheelchairs.

On the other hand, long-term care benefits are services that can be used by those who have been certified as needing long-term care 1 to 5. As for the service content, the same services as "preventive benefits" can be received, but unlike "preventive benefits", people with nursing care level 3 or higher can receive facility services, such as 24-hour nursing care, rehabilitation, and medical treatment. You can enter facilities such as special nursing homes for the elderly and long-term care health facilities. In addition, regular visits, as-needed home-visit nursing care, and night-time home-visit nursing care are available.

Preventive benefits and long-term care benefits are subject to monthly limits. The degree of nursing care is divided into 7 levels, 1 to 2 in need of support and 1 to 5 in need of nursing care. If you use the service within the amount limit, your copayment will be 10% (20-30% for those with income above a certain amount). If you use the service in excess of the limit, you will be responsible for the excess amount.

Nursing care insurance aims to reduce the burden on families and support nursing care by society as a whole against the backdrop of the increasing number of elderly people who need nursing care, the increasing number of nuclear families, and the separation from work due to nursing care. was founded in The long-term care insurance system is an important system for family caregivers and the elderly themselves to lead independent lives. If nursing care becomes necessary, it is important to consult with the municipality as soon as possible and consider using nursing care insurance.

MEDIUS Group is developing a business centered on the sale of medical equipment. We (Medical + us) involved in medical care also want to play the role of an information source (Media) that delivers useful information for the medical field and people's healthy tomorrow.